is the interest i paid on my car loan tax deductible

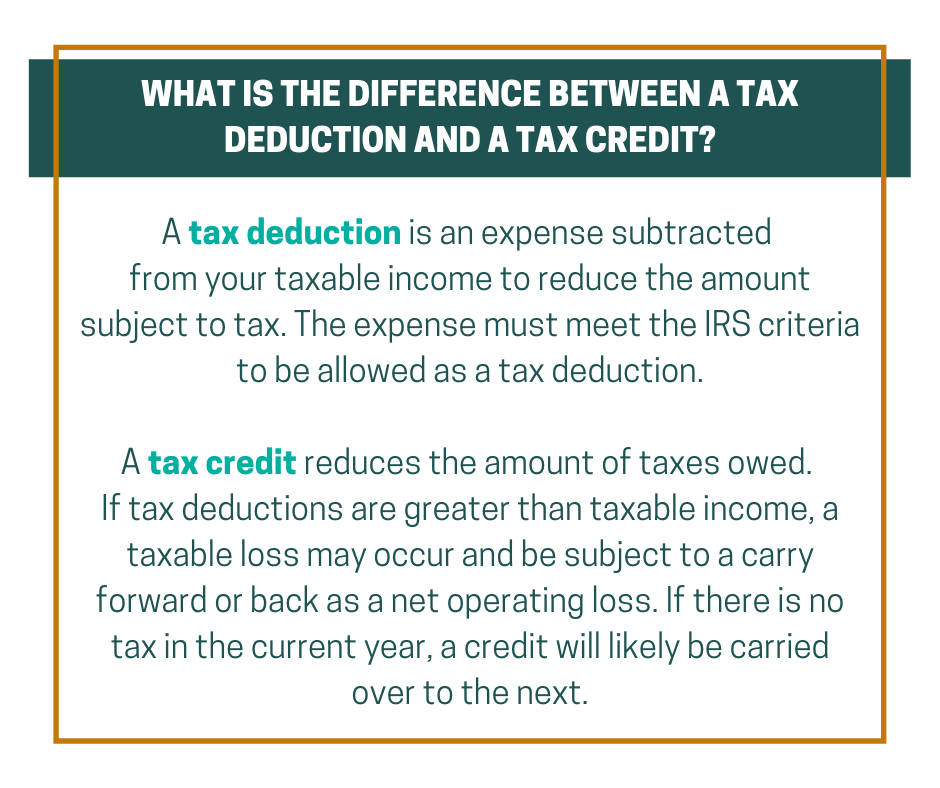

Some interest can be claimed as a deduction or as a credit. Thus as the interest on car loan is allowed to be treated as an expense this reduces.

10 Brilliant Budget Trackers For Your Bullet Journal Bullet Journal Budget Money Makeover Finance Bullet Journal

Car loan interest is tax deductible for commercial loans When you take out car finance to purchase a vehicle for use in your business the interest you pay on the loan is a business.

. Tax-deductible interest is interest paid on loans that the IRS allows you to subtract from your taxable income. You might pay at least one type of interest thats tax-deductible. Experts agree that auto loan interest charges arent inherently deductible.

But you cant just subtract this interest from your earnings and pay tax on the remaining amount. So you must keep careful records of the. This means that if you pay.

If you use your personal loan 100 to fund your business your interest payments are deductible. 1 answerUnless your car is for business purposes you cannot write off interest on a car loan. If your car use is 70 business and 30 personal you can only deduct 60 of your auto loan interest.

Only if the car is used for business the business portion of interest can be. Does the interest on a car loan reduce my income tax liability. The personal portion of the interest will not be deductible.

In order to do this your vehicle needs to fit into one of these IRS categories. Depending on whether the amount financed is above or below the depreciation limit will determine whether you can claim the lease as a tax deduction or the interest charges and depreciation of the vehicle. Unfortunately car loan interest isnt deductible for all taxpayers.

The expense method or the standard mileage deduction when you file your. You must report your tax-deductible interest to the IRS and this. The standard mileage rate already.

20000 business kilometres 25000 total kilometres 7160 5728 Heather can deduct 5728 as motor vehicle expenses for her 2021 fiscal period. As the interest on car loan is allowed to be treated as an expense this reduces the taxable profit which in turn reduces the Income Tax to be paid. Interest you pay on money used to generate income may be deductible if it meets the Canada Revenue Agency criteria.

But if you own your business or youre self-employed its a different story. However you need to be using the property to earn income by renting it out because solely residential property isnt. You can claim it even if you itemize your deductions and it may help you.

Read more about our Editorial Guidelines and How We Make MoneyDeducting auto loan interest on your income-tax return is not typica. The short answer is yes. To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take the deduction.

In this case neither the business portion nor the personal portion of the interest will be deductible. This is why you need to list your vehicle as a business expense if you wish to deduct the interest youre paying on a car loan. Less 10 Interest on Car Loan 10 of Rs.

This will therefore reduce your tax bill. Whether interest is deductible depends on how you use the money you borrow. However you can only deduct the amount attributable to business use 6.

For this you take a loan of 10 lakhs at 12 interest for one year. For more information see Publication 535 Business Expenses and Publication 550 Investment Interest and Expenses. When you prepay interest you must allocate the interest.

Maximizing Deductible Interest Some of the interest you pay on your mortgage loans or credit cards may be deductible on your tax return. As a result the interest payments could qualify for the student loan interest deduction and you may be able to deduct all the interest you paid for the year. To be classed as a car by HMRC the vehicle must not be designed for transporting goods and it must be suited to private use.

Interest on loan to buy vehicle 2200 Licence and registration 60 Total vehicle expenses 7160 Heather determines the motor vehicle expenses she can deduct in her 2021 fiscal period. You can claim the interest charged on your home loan as a deduction when completing your income tax return. If the loan is being used for mixed purposes you can only deduct a portion of the interest.

Should you use your car for work and youre an employee you cant write off any of the interest you pay on your auto loan. You can only write off a portion of your car expenses equal to the business use of the car. If your taxable income from the business is 30 lakhs for the year then 88 lakhs which is 12 of 10 lakhs can be deducted from your annual income while paying tax.

If you bought the car for 100 business use only you can deduct 100 of. Yes the interest on your car loan is deductible even if you use the standard mileage rate. Car loan interest is tax deductible if its a business vehicle You cannot deduct the actual car operating costs if you choose the standard mileage rate.

You may claim the cost of a car as a capital allowance. This means that if you pay 1000 in interest on your. No interest on a personal car is not tax deductible.

This means you can deduct some of the cars value from the profits of your business before paying tax. If you are leasing the vehicle as a business expense its possible to claim on some or even all of the GST from the rental fees. The student loan interest deduction is particularly valuable as its an above-the-line deduction technically making it an adjustment rather than a deduction.

You can with some limits deduct the interest you pay on debts. If the vehicle is entirely for personal use. May 31 2019 1138 PM.

If the vehicle is being used in part for business as an employee and the expenses are being deducted as an itemized deduction. Can you deduct car loan interest on your taxes. Interest paid on a loan to purchase a car for personal use.

Personal use is not deductible.

Are Car Finance Payments Tax Deductible Westside Auto Wholesale

Is Buying A Car Tax Deductible In 2022

Tax Credits Deductions For Your Transportation Business

2021 Rideshare And Delivery Driver Tax Deduction Guide Gridwise

Is Car Loan Interest Tax Deductible Lantern By Sofi

Is Buying A Car Tax Deductible In 2022

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Is Car Insurance Tax Deductible H R Block

Are Car Finance Payments Tax Deductible Westside Auto Wholesale

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

6 Common Miscellaneous Expenses Examples Tax Deduction Tips For Small Businesses

Personal Loan Tax Deduction Tax Benefit On Personal Loan Earlysalary

How To Maximize Your Tax Deductible Donations Forbes Advisor

German Tax Return Know Your Tax Deductible Expenses

13 Tax Deductible Expenses Business Owners Need To Know About Cpa Firm Accounting Taxes

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments