vermont state tax rate

Annual 2019 Tax Burden 75000yr income. To document additional taxes collected as a result of excess wear and tear andor excess mileage at the end of a motor vehicle lease contract.

Vermont Named 1 Least Tax Friendly State For Retirees Vermont Business Magazine Retirement Retirement Locations Retirement Advice

File or Pay Online.

. Average Sales Tax With Local. Vermont has state sales. Local Option Sales Tax.

Page 43 This column also applies to qualifying widower and civil union filing jointly status This column also applies to civil union filing separately status. Tax rate of 66 on taxable income between 67451 and 163000. 6 sales tax 1 7 total tax.

Understand and comply with their state tax obligations. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. Other Vermont Individual Income Tax Forms.

Ad Search Vt State Tax Table. Vermont collects a state corporate income tax at a maximum marginal tax rate of 8500 spread across three tax brackets. The tax is imposed on sales of tangible personal property amusement charges fabrication charges some public utility charges and some service contracts.

The statewide sales tax rate in Vermont is 6 which is relatively low compared to other states. Know what your tax refund will be with FreeTaxUSAs free tax return calculator. The state sales tax rate in Vermont is 6000.

Tax rate of 76 on taxable income between 163001 and 248350. Tuesday January 25 2022 - 1200. Each states tax code is a multifaceted system with many moving parts and Vermont is no exception.

Counties and cities in Vermont are allowed to charge an additional local sales tax on top of the Vermont state sales tax with 10 cities charging the additional 1 local sales tax. 9 Vermont Meals Rooms Tax Schedule. With local taxes the total sales tax rate.

The chart below breaks. Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers. Local Option Alcoholic Beverage Tax.

The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending on your income. 6 Vermont Sales Tax Schedule. Search Vt State Tax Table.

Lease Excess Wear Tear Excess Mileage Tax. Tax Year 2021 Personal Income Tax - VT Rate Schedules. Vermonts general sales tax rate is 6.

Location Option Sales Tax. Get Results On Find Info. State unemployment taxes are paid to this Department and deposited into a trust fund that can only be used for the payment of benefits.

RateSched-2021pdf 3251 KB File Format. 5 rows The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as. 9 rows Vermont has a progressive state income tax with a top marginal rate that ranks as one of the.

Tax Rate 0. FY2023 Property Tax Rates. For married taxpayers living and working in the state of Vermont.

State and Federal Unemployment Taxes. To apply for a lesser tax due at the time of registration when disagreeing with NADA value. Employers pay two types of unemployment taxes.

9 meals tax. Tax rate of 875 on taxable income over 204000. Local Option Meals and Rooms Tax.

Local Option Meals Tax. Tax rate of 335 on the first 67450 of taxable income. Vermonts tax system ranks 43rd overall on our 2022 State Business Tax Climate Index.

There are a total of eleven states with higher. Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent. The state tax is payable on the first 15500 in wages paid to each employee during a calendar year.

Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. The federal government gives each state the power to adopt its own tax system in addition to the tax code enforced by the Internal Revenue Service IRS. A municipality may vote to levy the following 1 local option taxes in addition to state business taxes.

A few cities collect an additional local tax of 1. Local option tax is a way for municipalities in Vermont to raise additional revenue. Vermont Percentage Method Withholding Tables for wages paid in 2020.

Usa State Taxes 2017 950 5b Usa Veterans Volunteer Services Veteran Owned Business

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

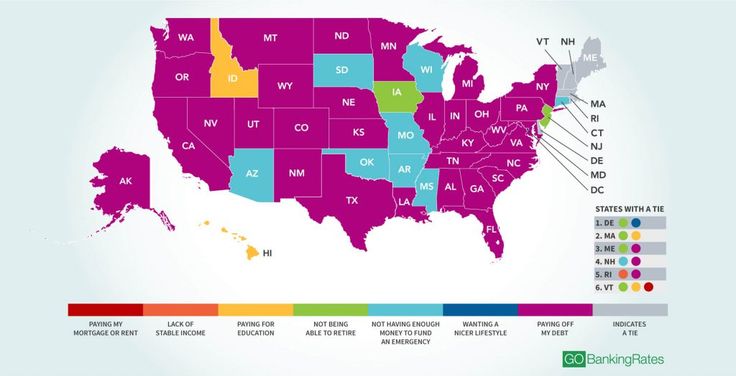

The No 1 Cause Of Financial Stress In Every State

The Best And Worst States For Retirement Ranked Huffpost Life Retirement Best Places To Retire Retirement Community

Savage Pond Unit 2 Stowe Townhome For Sale Stowe Homes For Sale 1 Top Real Estate In Stowe Vt

States That Tax Six Figure Incomes At A Higher Rate Accidental Fire

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Interest Mortgage

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

States With The Highest And Lowest Property Taxes Property Tax Tax High Low

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

This Map Shows Where The Most Debt Burdened People In America Live Student Loans Map Debt

This Map Explains Why Midwesterners Find New Yorkers Weird History Mystery Of History Historical Maps

Mean Elevation Of Each State In The U S Oc 2300x1500 Illustrated Map Map Usa Map

States That Won T Tax Your Retirement Distributions Retirement Retirement Income Tax