are funeral expenses tax deductible in 2020

English to libyan arabic. But for estates valued above 114 million in 2019 or 1158 million in 2020.

Which Expenses Are Deductible In 2020

Niddah laws after childbirth.

. Goldman sachs asset management salary. Deducting funeral expenses as part of an estate. Big spring high school prom.

7021 hollywood blvd los angeles ca 90028 1 301 202-8036 6335 Green Field Rd. In such cases the deductible expenses may include expenses such as mortuary cremation cemetery tombstone burial lot flowers luncheon clergy and so on. Statistical Facts Show You Can Benefit.

The IRS deducts qualified medical expenses. But for estates valued above 114 million in 2019 or 1158 million in 2020 deducting funeral expenses on the estates Form 706 tax return would result in a tax saving. Only the estate of the deceased receives tax deductions for funeral expenses.

No never can funeral expenses be claimed on taxes as a deduction. Live wedding painting bay area. Unit 1712 Elkridge MD 21075 USA.

Funeral expenses are not tax deductible because they are not qualified. The Internal Revenue Service IRS sets strict rules about what expenses can and cannot be deducted from your tax bill. According to the National Funeral Directors Association in 2021 the average cost of a funeral with a viewing and burial was about 7900.

You cant take the deductions. The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible. Funeral and burial expenses are only tax deductible if.

Funeral and burial expenses can be deducted if they were paid out by the estate of the deceased person. The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a decedents. Cremation costs were slightly lower at an.

Just another site are funeral expenses tax deductible in 2020. Funeral Costs as Qualifying Expenses. Are funeral expenses tax deductible in 2020.

An individual who pays funeral expenses does not receive tax deductions. If you are settling an estate you may be able to claim a deduction for funeral expenses if you used the estates funds to pay for. IRS rules dictate that all estates worth more than 1158 million in the 2020 tax year are required to pay federal taxes at which point they can take advantage of tax deductions on.

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

How To Handle Medical Expenses Including Marijuana On Your Tax Return Oregonlive Com

Three Things You Need To Know About Taxes At Death Beffa Law

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Frequently Asked Questions Faqs

What S New For 2021 Income Tax Prep Trail Daily Times

People Should Be Aware These Are Taxable Benefits Tax Planning For Cerb Salmon Arm Observer

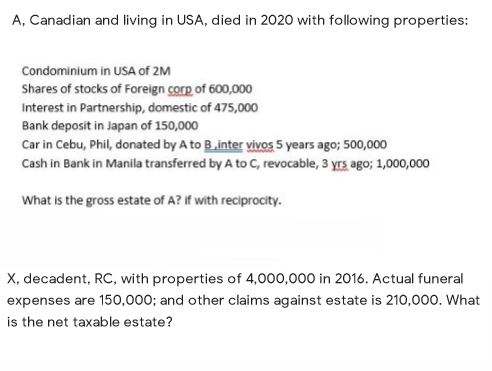

Solved Solve The Following Problems Base On The Business Taxation Laws Of Course Hero

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Irs Announces Higher Estate And Gift Tax Limits For 2020

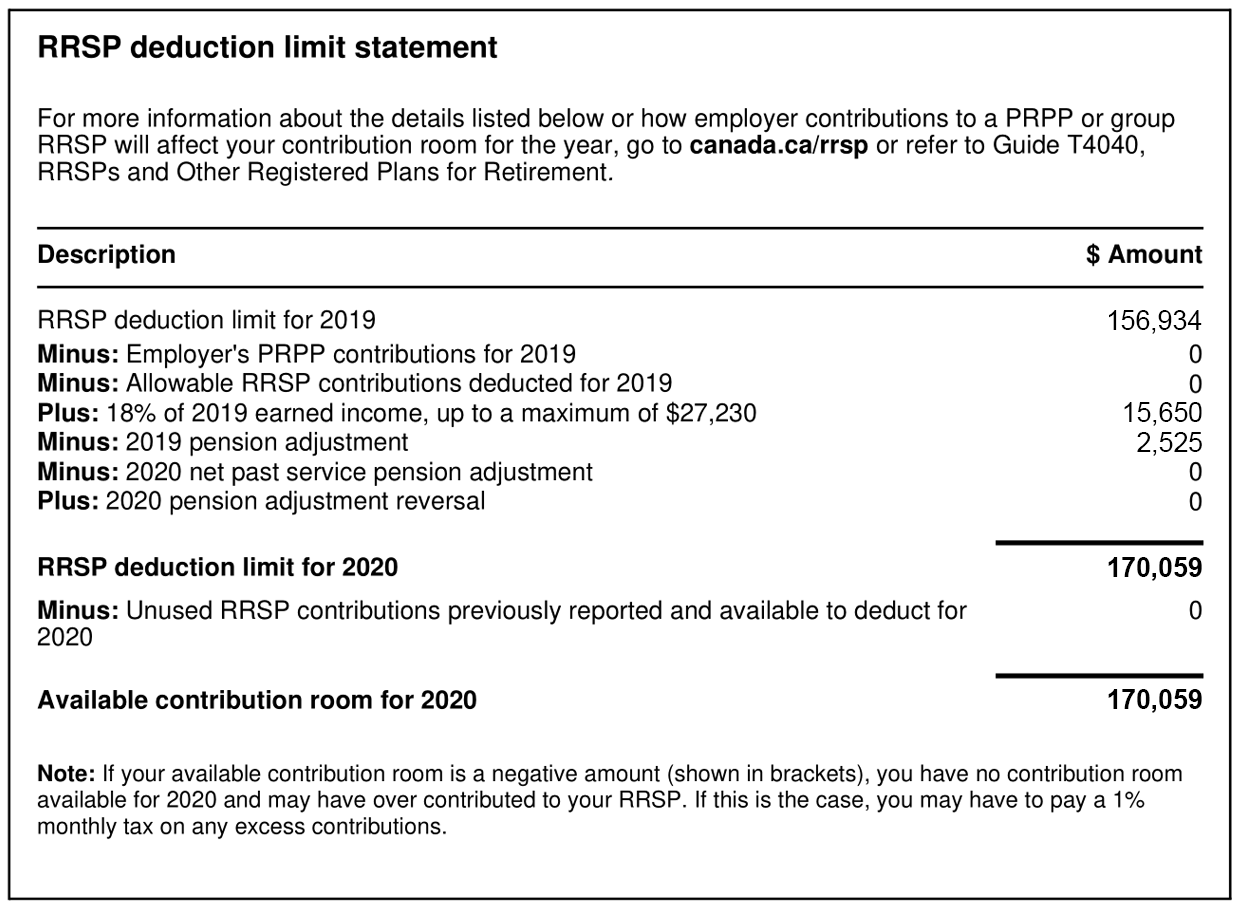

Why Is 2021 An Important Year For Your Rrsp Apluswealth Inc

Solved A Canadian And Living In Usa Died In 2020 With Chegg Com

Amber Wedding Seating Chart Template Printable Seating Etsy Seating Chart Wedding Template Seating Chart Wedding Wedding Posters

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

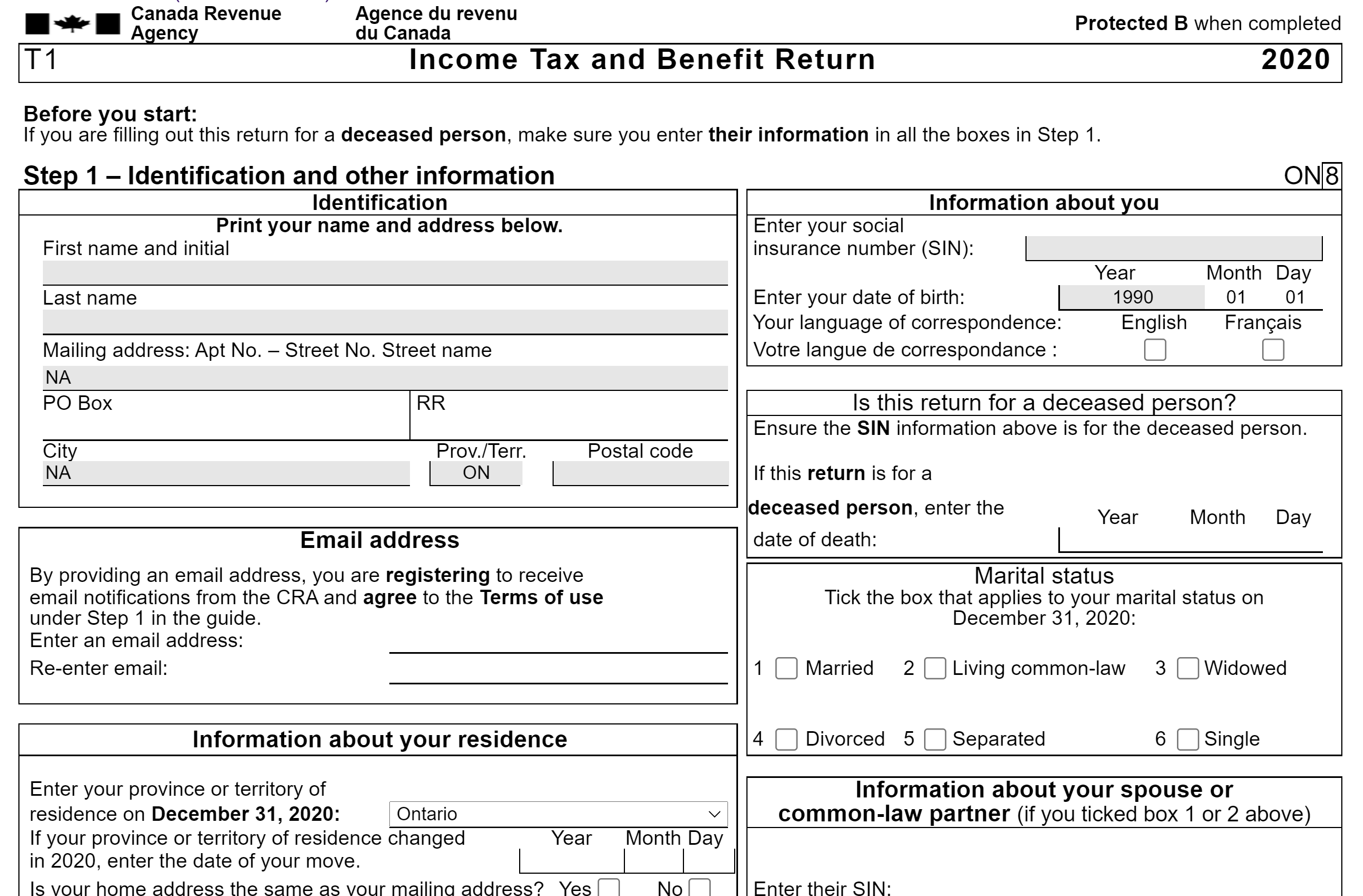

What Is A T1 General Tax Form Canada Buzz