does texas have an estate tax

As long as the estate in question does not have assets exceeding 1170 million for 2021 or 1206 million in 2022 you are most likely not on the hook for federal estate or. The federal estate tax is a tax on property cash real estate stock or other assets transferred from deceased persons to their heirs.

Tax Savings Is Just One Of The Many Benefits Of Homeownership These Are Some Of The Items That Can Be Home Ownership Real Estate Tips Estate Tax

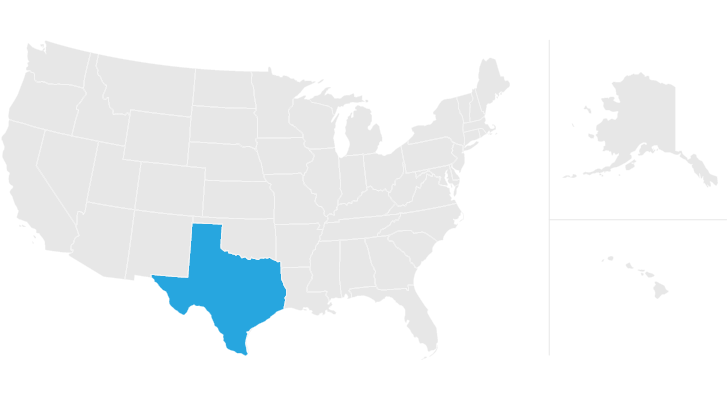

This is strange given Texas has no state income tax and no state estate tax.

. Connecticuts estate tax will have a flat rate of 12 percent by 2023. There is a 40 percent federal tax however on estates over 534. The federal government eliminated inheritance taxes and instituted an estate tax policy that most states including Texas follow.

However Texas does have the sixth highest property tax rate in in the US. What is the difference between inheritance and estate taxes and when does a Texas resident have to pay the estate tax. That said you will likely have to file some taxes on.

There are no inheritance or estate taxes in Texas. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. 1206 million will be void due to the federal tax exemption.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Fortunately Texas doesnt have an estate tax and is one of the dozens of states without it. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up. The estate tax rate is currently 40. No estate tax or inheritance tax.

The executor or administrator is required to among other things prepare and file all of the tax returns due both for the decedent and for the. Illinois estate tax exemption increased to 35 million effective. Therefore Texans will only have to worry about the federal estate tax on their properties.

While Texas doesnt have an estate tax the federal government does. So until and unless the Texas legislature changes the law which. Counties in Texas collect an average of 181 of a propertys assesed fair market.

No estate tax or inheritance tax. In 2011 estates are exempt from paying taxes. The state of Texas does not have an estate tax however residents may still be subject to federal estate tax laws.

Estates valued between 1 million and 2 million paid slightly less in estate taxes and estates valued over 2 million paid more. The top estate tax rate is 16 percent exemption. Does Texas have an estate tax.

However less than 1 of the population in Texas or. As of 2021 the federal estate tax only kicks in once the deceaseds estate is valued at above 117. At the state level there is not an estate tax in Texas to be concerned about by anyone but at the federal level there is.

Texas ended its state inheritance tax return for all persons dying on or after January 1st 2005. Texas does not have an estate tax either. The tax is determined separately for each beneficiary who is then responsible for paying any inheritance taxes.

The state repealed the inheritance tax beginning on Sept. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. Estate tax is only levied on property that.

The Texas Franchise Tax. Some states have estate taxes too. Fortunately Texas is one of the 33 states that does not have an.

If you live in Texas and are thinking about estate planning. With a base payment of 345800 on the first 1000000 of the estate. However localities can levy sales taxes which can reach 75.

Higher rates are found in locations that lack a. Oregons estate tax rates changed on Jan. A Closer Look The Matter of Texas Probate Taxes.

However Texas is not one of those states. Alaska is one of five states with no state sales tax. No estate tax or inheritance tax.

This means that any estates that are valued over 117 million dollars will be taxed before any assets are. Ballot Measure 84 which would have repealed Oregons estate tax was defeated in November 2012.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

What Is Estate Planning Basics Checklist For Costs Tools Probates Taxes Estate Planning Estate Planning Attorney Estate Tax

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem Real Estate New Homeowner Estate Tax

Taxes On Selling A House In Texas What Are The Taxes To Sell My Home In 2022 Property Tax Property Valuation Estate Tax

Texas State Taxes Forbes Advisor

Pin By San Antonio Board Of Realtors On Take Action Consumer Protection Estate Tax Facts

Create A Strong Sophisticated Design For Texas Tax Financial Estate Advisory By Tianeri Logo Branding Identity Logo Branding Fashion Logo Design

What Qualifies As A Homestead The Word Homestead May Conjure Up Images Of Pioneers Staking Their Claim On Th Republic Of Texas The Conjuring Things To Sell

The Long Long History Of The Texas Property Tax

State And Local Tax Deductions Data Map American History Timeline Usa Map

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease

Cost Segregation For Hotels Personal Property Estate Tax Hotel

Texas Estate Tax Everything You Need To Know Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Texas Estate Tax Everything You Need To Know Smartasset

Texas Inheritance Laws What You Should Know Inheritance Law Community Property